COGNITIVE BIAS

Avoiding Outcome Bias

Published date: 4 November 2024 | 5-Min Read

In investing, it’s easy to equate a good outcome with a good decision.

After all, if an investment pays off, doesn’t that mean the decision-making process was sound from the start?

This seemingly logical thinking is actually a cognitive trap called Outcome Bias—where we judge a decision based on its result rather than the quality of the decision-making process itself.

In investing, outcome bias can be particularly misleading, often leading to misplaced confidence, an underestimation of risks, and misguided future decisions.

What is Outcome Bias?

Outcome bias is the tendency to evaluate a decision based on its eventual outcome rather than the factors and reasoning that led to the decision.

For example, if an investor makes a risky bet that pays off, they might view it as a „good“ decision simply because they made a profit, even though the decision itself was poorly grounded.

Conversely, an investor who makes a well-researched decision that doesn’t pan out might wrongly assume that their strategy was flawed. This way of thinking can distort learning from past experiences, leading investors to overlook valuable insights about risk, probability, and sound strategy.

This way of thinking can distort learning from past experiences, causing investors to overlook valuable insights about risk, probability, and sound strategy. A survey by Behavioral Finance Forum found that 61% of retail investors mistakenly attributed their investing success to skill rather than luck after profitable outcomes, while 48% struggled to identify the role of external factors in their decisions.

Bitcoin Mania: Luck Isn’t Skill

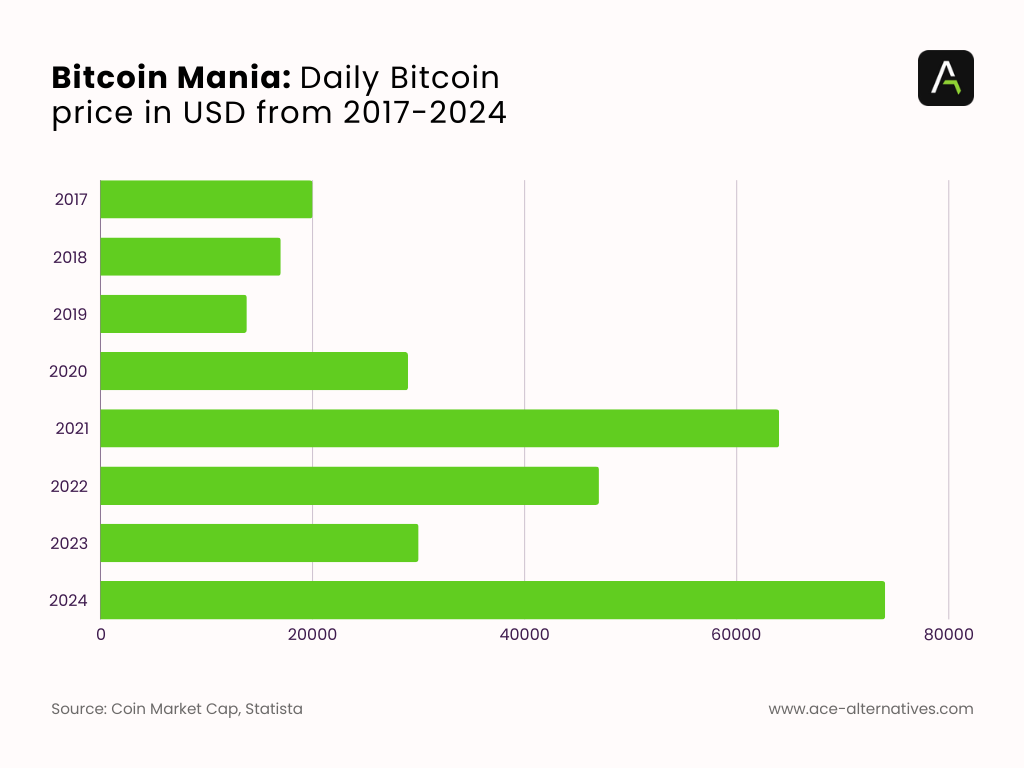

One of the most vivid illustrations of outcome bias is the repeated cycles of Bitcoin speculation. Investors flocked to Bitcoin in 2017, 2021, and again in 2024, driven by massive price surges:

- 2017: Bitcoin peaked at nearly $20,000 before plummeting to around $3,200, an 84% decline.

- 2021: Bitcoin reached $64,000 in April, then fell to about $30,000 by July—a 53% drop.

- 2024: Bitcoin hit a new high of over $74,000 in March, followed by moderate fluctuations around $72,000 by November.

Daily Bitcoin Price in USD from 2017 – 2024

During these peaks, many investors jumped into Bitcoin driven by FOMO (Fear of Missing Out) and attributed their gains to skillful decision-making rather than market timing or luck.

A study by Fidelity Investments Investments revealed that 43% of retail investors were overconfident in their understanding of cryptocurrency after achieving short-term gains (Fidelity, 2022). This overconfidence often led them to ignore risks, assuming that past success guaranteed future returns.

How It Impacts Investors

1. Encourages Risky Behavior

Outcome bias can make venture capitalists or private equity investors more likely to take on additional high-risk investments based on previous successes. For example, if a VC firm backs an early-stage startup in a volatile sector like crypto or biotech and sees substantial returns, they may assume their investment approach is sound and repeat the strategy across similar high-risk opportunities. However, this ignores the role that timing or market conditions may have played in that initial success. Continuing to chase similar high-risk deals without critical assessment can lead to ill-informed decisions that jeopardize future fund performance.

2. Discourages Learning from Mistakes

When investors judge a decision solely by its outcome, they miss critical learning opportunities. A „bad“ outcome might discourage them from revisiting a sound strategy that could be successful under different circumstances. A survey by Schwab found thatonly 35% of investors consistently reviewed unsuccessful investments for insights(Schwab, 2023).

3. Fosters Overconfidence

Outcome bias can lead investors to believe that their success is entirely due to their skill, fostering overconfidence. Overconfident investors often underestimate risks, make impulsive decisions, and ignore critical information. According to a study by the CFA Institute, overconfident investors trade 40% more frequently and earn lower net returns due to transaction costs(CFA Institute, 2020).

4. Promotes Short-Term Focus

Outcome bias can lead investors to evaluate decisions based on short-term results rather than long-term objectives. A single quarterly report may be enough for some to abandon a long-term investment strategy prematurely. This myopic focus on immediate results rather than sustained value can interfere with a portfolio’s growth and resilience over time.

The Role of Luck in The Short-Term

Understanding the distinction between decision quality and outcome quality is crucial to avoid outcome bias. For instance, a venture capitalist might invest heavily in a trending sector and see impressive returns. However, this success doesn’t necessarily validate their decision-making. Concentrating on a high-risk, hype-driven sector could yield gains due to market conditions or timing rather than skill. Ignoring the role of luck in such outcomes may lead to overconfidence and potential misjudgments in future investments.

A study by Vanguard analyzed investor returns and found that in any single year, luck explains up to 50% of individual investor performance (Vanguard, 2022). Over time, repeated decisions based on solid strategy—not luck—are more likely to yield positive results.

The Brain’s Bias Toward Positive Outcomes

Outcome bias is reinforced by our brain’s dopamine response to success. When a decision yields a good outcome, dopamine reinforces the behavior, making us more likely to repeat it. This is why a lucky outcome, like profiting from a risky investment, can reinforce risky decision-making patterns. Neuroscientific research has shown that dopamine release strengthens memory pathways associated with successful outcomes, even if those outcomes were random ( Harvard Business Review, 2021 ).

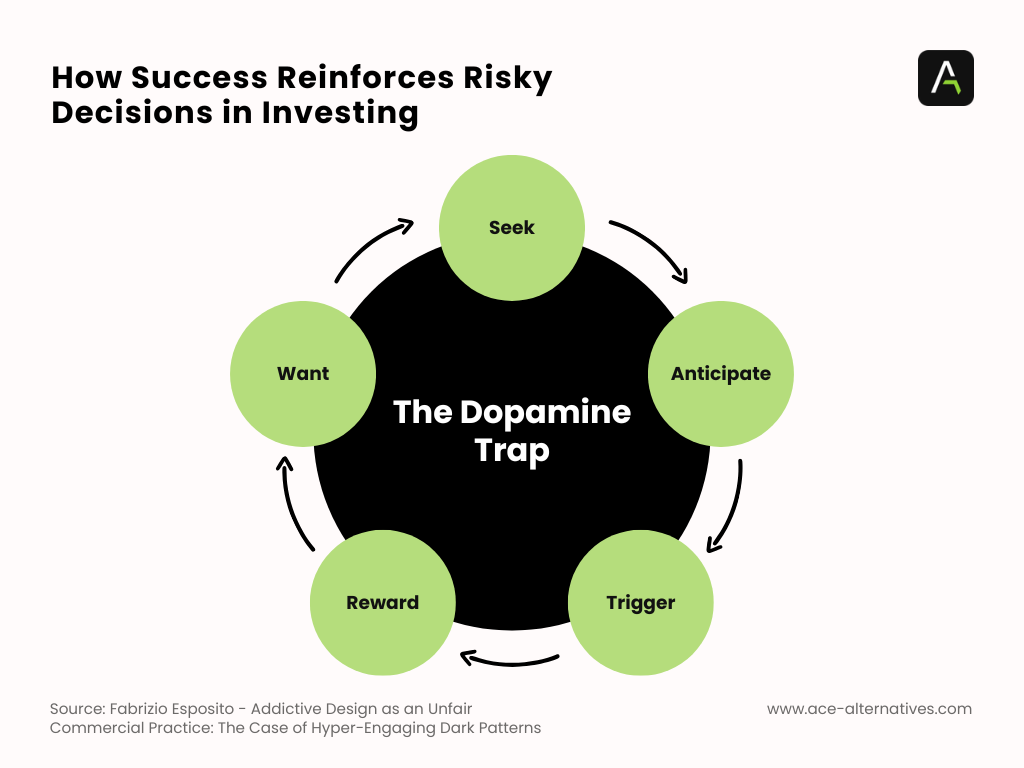

The Dopamine Cycle

The Dopamine Cycle

The Dopamine Cycleis a critical driver of outcome bias in investing. When an investment yields a positive return, the brain’s dopamine system reinforces the behavior, creating a loop that encourages investors to repeat similar decisions. Here’s how it works:

- Seek: Investors continuously seek profitable opportunities, often driven by past wins.

- Anticipate: As they identify high-potential investments, anticipation builds, driven by the possibility of another successful outcome.

- Trigger: A decision point arrives, often influenced by external factors like market trends or hype.

- Reward: When the investment pays off, dopamine release reinforces the satisfaction and perceived „skill“ behind the decision.

- Want: This reward creates a desire to repeat the cycle, making investors more likely to pursue similar, sometimes riskier, opportunities in the future.

This dopamine-fueled cycle can mislead investors into assuming their successes are due to skill rather than external factors or luck, reinforcing risky behavior. As a result, outcome bias solidifies, leading investors to overlook critical decision factors and become increasingly overconfident. Recognizing this cycle is essential for investors aiming to break free from over-reliance on lucky outcomes and focus on rational, well-researched decisions.

Avoiding Outcome Bias in Investing

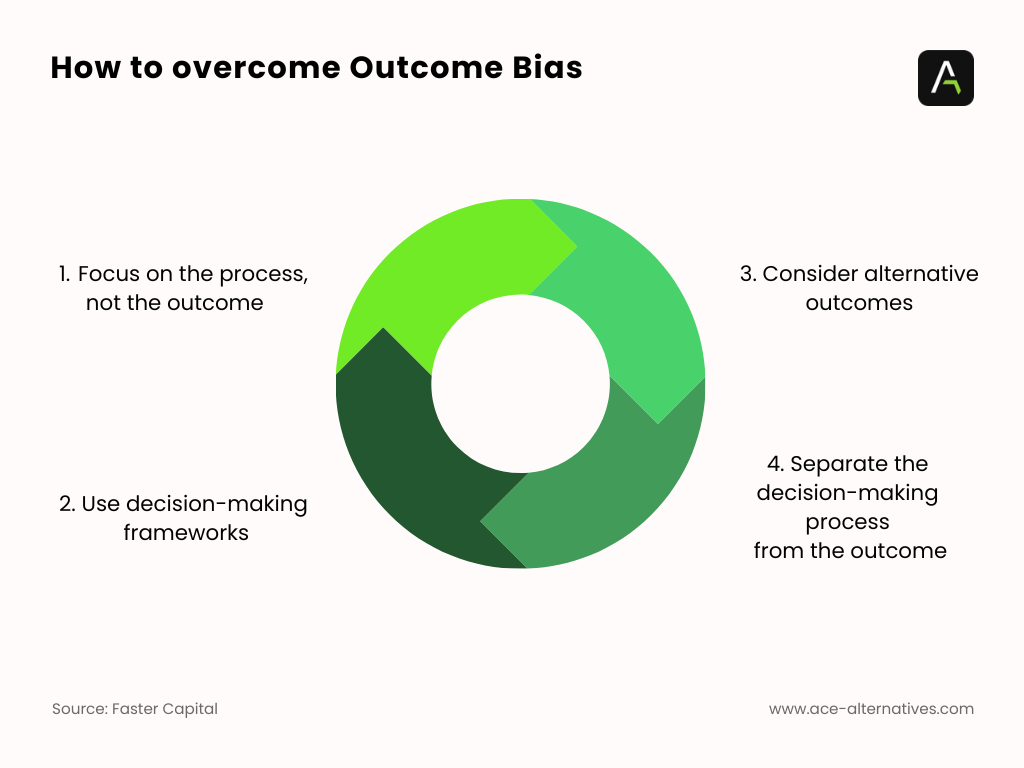

Overcome Outcome Bias (4 Tips)

1. Focus on the process, not the results

In investing, focusing on the process means emphasizing sound research, analysis, and discipline rather than just the end result. A positive outcome doesn’t necessarily reflect a good decision, as luck and market conditions can play a significant role. By prioritizing a consistent, well-thought-out approach, investors can make better decisions over time, regardless of short-term results. This mindset helps to build resilience and prevents chasing quick wins that may be driven by luck rather than strategy.

2. Use decision-making frameworks

Decision-making frameworks provide a structured approach to evaluating investments, helping investors avoid impulsive choices. Frameworks like checklists, probabilistic thinking, or risk-reward analyses ensure that all critical factors are considered before deciding. Using these tools can reduce cognitive biases, making the decision process more rational and less influenced by emotions or recent outcomes. They encourage investors to approach each choice with a systematic and repeatable process.

3. Consider alternative outcomes

Acknowledging that multiple outcomes are possible encourages investors to account for uncertainty and avoid overconfidence. By considering best-case, worst-case, and most likely scenarios, investors are better prepared for potential risks and surprises. This approach reduces the chance of being blindsided by unexpected events and fosters a more balanced view of possible rewards and downsides, leading to more measured and informed investment choices.

4. Separate the decision-making process from the outcome

Separating the decision process from the outcome helps investors avoid judging decisions solely by their results. A well-made decision can sometimes lead to a poor outcome due to factors beyond anyone’s control, and vice versa. By assessing the process independently, investors can improve their strategies based on the quality of their analysis and execution, rather than the result alone. This separation allows for continuous improvement in decision-making, regardless of short-term wins or losses.

Conclusion

Outcome bias is a subtle but influential cognitive trap in investing, often leading individuals to misinterpret success as a sign of good decision-making while discouraging valuable lessons from failure. By focusing on the quality of the process, embracing probabilistic thinking, and evaluating strategies over the long term, investors can cultivate a more rational and disciplined approach. In the world of investing, where uncertainty reigns, separating decisions from outcomes is an essential skill for building lasting wealth and resilience.

Consulting a range of opinions can counterbalance overconfidence and help investors see beyond an outcome-focused evaluation. By considering alternative scenarios and inviting critique, investors are more likely to avoid relying solely on previous outcomes to guide future decisions.

A single investment outcome is rarely representative of an entire strategy’s validity. Tracking the performance of an investment strategy over time—rather than focusing on individual outcomes—can provide a clearer picture of whether the approach is effective. A successful investment record built over time is a better indicator of skill than a few one-off successes.

It’s important to examine both successful and unsuccessful investments with a critical eye. Understanding why a decision worked out, or why it didn’t, can help investors learn valuable lessons without falling prey to outcome bias. Analyzing factors such as the original thesis, execution, and external influences can yield insights that improve future decisions.

Sources:

Rolf Dobelli, “The Art of Thinking Clearly” (2013)

About ACE Alternatives

ACE Alternatives, a leader in managed services for the Alternative Assets sector, specializes in venture capital, private equity, fund of funds, private real estate, and more. Leveraging tech-driven processes and extensive industry experience, ACE offers tailored solutions for fund administration, compliance and regulatory, tax and accounting, investor onboarding and ESG needs.

Our vision is to redefine fund management standards with data-driven processes, combining advanced technology with deep industry knowledge. We are committed to demystifying complex fund operations, promoting transparency, and achieving sustained growth across the fund lifecycle.