COGNITIVE BIAS

How did a stranger’s house spark a fear of regret?

Published date: 8 October 2024 | 5-Min Read

Why do incomplete tasks linger on your mind?

One of the most powerful motivators of human behavior is the desire to avoid regret. Venture capitalists know this feeling all too well, as the choices we make (or don’t make) can have lasting consequences—both financial and emotional.

The fear of regret can drive investors toward safer bets or paralyze them from acting at all.

This concept, studied deeply by behavioral economists like Daniel Kahneman and Amos Tversky, plays a critical role in understanding how investors evaluate opportunities and manage risks.

Take the case of Airbnb. On June 26, 2008, the founders of Airbnb pitched their idea to seven prominent Silicon Valley investors, offering a 10% stake in the company for $150,000.

Five investors rejected them outright, and the other two didn’t even reply.

At the time, the idea of vacationing in a stranger’s home seemed far too unconventional, and the risk appeared too great. The investors believed they were making a sound, cautious decision.

But looking back, the missed opportunity is staggering.

That 10% stake in Airbnb would now be worth billions!

The investors who passed on Airbnb are a classic example of how the fear of regret can cloud judgment. They feared taking a chance on something outside the norm only to realize later how much they missed out on. In retrospect, their inaction led to immense regret, as they watched Airbnb grow into one of the most successful companies of the modern era.

What is the fear of regret?

But what is the fear of regret, exactly?

Regret is the feeling of wishing we had made a different choice after knowing the outcome. It can stem from both action and inaction, but studies show that regret is often more intense when we take action and the result is unfavorable. This is particularly true when decisions deviate from the norm. In investing, this often leads to a bias toward maintaining the status quo, just as those investors did when they passed on Airbnb.

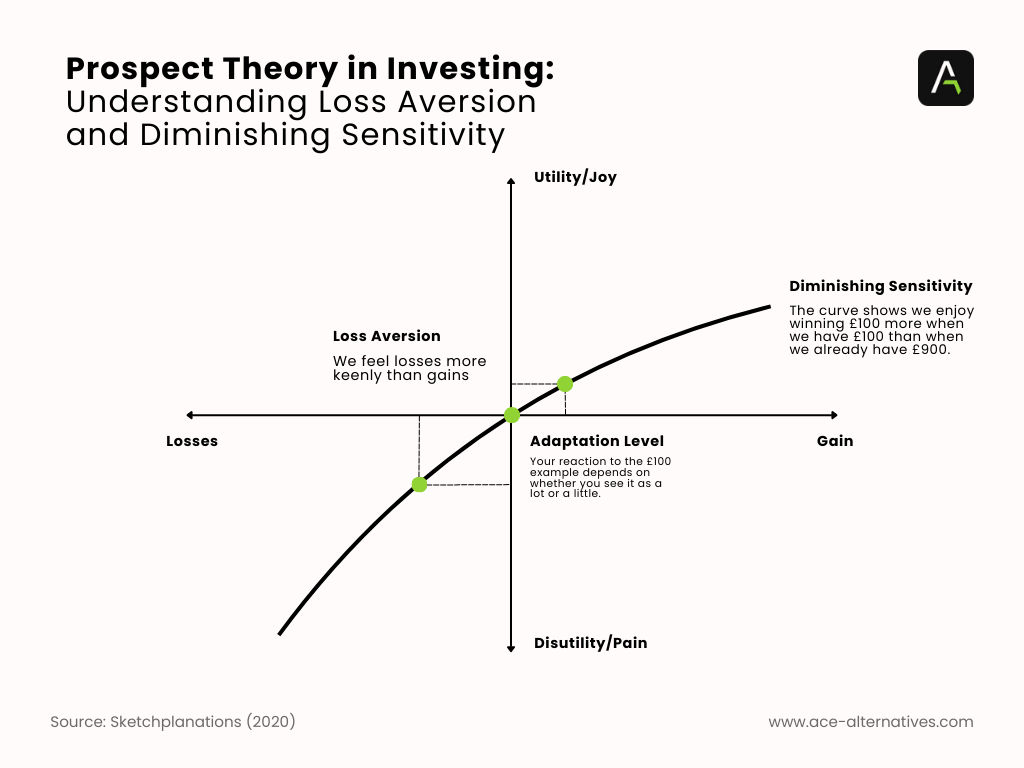

Daniel Kahneman and Amos Tversky formalized this phenomenon through prospect theory and loss aversion. While their research extended beyond regret avoidance, they identified how deeply the fear of regret influences decision-making.

Essentially, the pain of losing something tends to feel two to three times worse than the pleasure of gaining an equivalent amount.

This can be illustrated by a simple psychological experiment: Imagine you’re playing a game where I hide two dice—one red and one white—under two identical cups. You pick a cup at random, knowing there’s a 50-50 chance of being right. After you choose, I offer you the option to switch cups. Statistically, switching should offer no greater or lesser chance of success, yet around 90% of people will stick with their original choice.

Why?

Because switching introduces the fear of regret—what if you change your pick and your original choice was right?

This is the same mechanism that paralyzes investors. Much like the game, many would prefer to stick with their current investments rather than risk moving into unfamiliar territory. It’s not necessarily rational, but it’s human.

The cost of staying put

In investing, this tendency to stay with the familiar can have significant consequences, as seen in the case of Airbnb.

Imagine two venture capitalists: Alex, who considered investing in Airbnb but stuck with more traditional startups, and Sam, who sold his shares in another company to invest in Airbnb. Years later, Alex regrets missing out on the massive gains from Airbnb’s success, just as Sam might regret selling his initial holdings if they had outperformed Airbnb‘ returns.

While both investors face the same financial shortfall, studies show that active decisions like Sam’s—selling one stock to buy another—typically lead to greater regret than passive decisions like Alex’s. This is because taking action feels riskier and exposes us to regret if things go wrong.

Prospect Theory in Investing: Loss Aversion and Sensitivity

This same psychological pattern can be seen in the decisions made by those early Airbnb investors. They chose to stay with more conventional investments, avoiding what appeared to be a risky bet. But the subsequent success of Airbnb transformed their hesitation into a significant financial regret. Their decision to avoid what seemed to be a risk was, in fact, a greater risk in hindsight.

The role of loss aversion

A key concept tied to regret is loss aversion, which describes how people prefer avoiding losses to acquiring equivalent gains. This is why, in experiments like the dice game, people need significant incentives—up to ten times the potential gain—to overcome their fear of switching. Even when switching offers a better outcome, the potential regret of changing their mind and being wrong prevents them from acting.

This reluctance to act can also be seen in larger financial decisions, like investing in disruptive startups. Venture capitalists often grapple with loss aversion, preferring safer, established investments over emerging companies with higher risks. In the case of Airbnb, many of those early investors were hesitant to deviate from the norm because they feared the regret of making a bad call. Ironically, their decision to avoid risk is what ultimately led to their biggest regret.

Overinvestment and the Pinterest paradox

While fear of regret can lead to missed opportunities, it can also lead to overinvestment once an opportunity starts gaining traction. The case of Pinterest provides a clear example of how investors’ fear of missing out (FOMO) and over-investment played out during its early funding rounds.

In May 2011, Pinterest raised $10 million in its Series A round, with a valuation of around $40 million. Bessemer Venture Partners (BVP) led this round after previously passing on earlier opportunities to invest. Just five months later, in October 2011, Pinterest’s valuation skyrocketed to $200 million during its Series B round, led by Andreessen Horowitz (a16z), which raised $27 million.

The fear of regret is evident here. Investors who passed on the Series A round had to pay five times more to invest in Pinterest during the Series B stage. Those who waited experienced the pain of knowing they could have entered earlier at a much lower valuation, similar to the investors who missed out on Airbnb.

Even though Pinterest’s Series B investors, such as Andreessen Horowitz, still saw significant returns—around 50x by the time Pinterest went public in 2019—it was the Series A investors who truly reaped massive rewards, with returns upwards of 250x.

BVP, which eventually entered at Series A, capitalizez on this astronomical growth, but others who delayed felt the sting of regret.

The rapid jump in Pinterest’s valuation between these two funding rounds illustrates the dynamics of overinvestment driven by fear of regret. Some investors, afraid of missing out on the next big thing after passing on Series A, overinvested in later rounds, limiting their upside. While still profitable, their returns were significantly lower than those who got in early.

The balance between risk and regret

The stories of Airbnb and Pinterest provide important lessons for venture capitalists. Fear of regret can lead to two very different outcomes: either missing out on a massive opportunity, as seen with Airbnb, or over-investing out of FOMO, as seen with Pinterest. Investors must balance their desire to avoid regret with a clear assessment of risk and reward.

Missing early rounds can be costly, but overcorrecting due to fear can also lead to diminished returns. The key is to develop a disciplined approach to evaluating opportunities—recognizing when the fear of regret clouds judgment and when it’s time to take a calculated risk. The success stories of Airbnb and Pinterest remind us that taking chances on unconventional ideas can lead to extraordinary returns, but only if we learn to wisely manage our fear of regret.

In the world of venture capital, the greatest regret often comes not from acting and failing, but from failing to act at all.

Sources:

- Rolf Dobelli, “The Art of Thinking Clearly” (2013)

- 7 Rejections Brian Chesky (2015)

- How Fear of Regret Influences Our Decisions by Geoffrey Engelstein

About ACE Alternatives

ACE Alternatives (“ACE”) is a leader in managed services in the Alternative Assets sector like venture capital, private equity, fund of funds, real estate, and more. Leveraging a proprietary tech platform and extensive industry experience, ACE offers 360 degree tailored solutions for fund administration, compliance and regulatory, tax and accounting, investor onboarding and ESG needs.

The fintech was founded in Berlin in 2021 and has since established itself as one of the fastest growing alternative investment fund service providers in Europe. ACE is currently used by over 45 funds. In 2024, ACE received seven-figure funding from Bob Kneip to expand into new markets. ACE’s vision is to redefine fund management by demystifying complexities and promoting transparency.